An advisory group headed by Governor Josh Green was established to explore strategies for stabilizing the market, which has been severely damaged by climate-related disasters.

James Clemens found it astonishing that the insurance cost for the Terraces at Manele condo association in 2024 was $109,000 instead of $69,000, a more than 40% increase in rate.

According to Clemens, the condo board is still attempting to determine how to pay for the cost hikes, but condo owners will eventually have to bear the expense in one way or another. According to Clemens, the typical owner of the 26 free-standing condominiums on Lanai may see a $600 rise in their monthly association dues.

Serving as president of both the condo association and the local homeowners’ organization that oversees three further condo associations and many single-family houses, Clemens said, “It’s a huge boost for everybody.”

Interesting Story: Hanne Norgaard’s Untold Story of Success and Inspiration

Clemens, an 80-year-old retired Philadelphia carpenter, and his spouse Sally initially purchased a house on Lanai in 1995. These days, the pair divides their time between Oahu, where they own a second property in Kakaako, and Lanai. The fact that the pair can afford the hike, according to Clemens, is lucky. Not everyone who retires on a fixed income will be as fortunate.

He declared, “This is going to impact everybody.”

He is accurate. There are several accounts of premiums increasing or doubling throughout Hawaii. The yearly cost for a single Waikiki apartment increased to $1.2 million from $235,000 the year before, according to a House measure that was submitted during the most recent session to address the growing rates. The amount of deductibles has also surged.

Both the House and Senate versions of the measure were killed. However, policymakers are reorganizing. To stabilize the insurance market, Governor Josh Green earlier this month announced the formation of a new Climate Advisory Team.

On Thursday, the Hawaii Economic Association will conduct a webinar in which House Speaker Scott Saiki will speak with executives from the banking and insurance industries about the problems surrounding condo insurance.

The session was moderated by Hawaii economist Seth Colby, who declared, “This is going to be with us long-term.” This does not only apply to Hawaii.

Colby said, “Risk will shift as climate change takes root, and pricing need to reflect those risks.”

Hawaii is Among the States with a High-Risk Profile.

There are several states with insurance markets that are out of control, not just Hawaii. The news outlet CalMatters revealed earlier this month that despite various efforts by public servants and private property owners, California is still experiencing an insurance issue.

Not just large coastal and wildfire-prone states are going through turbulence, though. Earlier this year, the online insurance marketplace Insurify examined data on insurance premiums and property prices from all 50 states to demonstrate how climate disasters were influencing housing prices nationally. Based on variables like housing costs, salary growth, and insurance premium hikes from 2022 to 2023, Insurify’s ranking of the ten least expensive states for insurance coverage included Oklahoma and Nebraska.

Nevertheless, the trend in the islands has been astounding for homeowners in Hawaii. The biggest locally owned property and casualty insurer in the state, Island Insurance, stopped renewing its subscribers’ storm coverage earlier this year. Executives at Island Insurance released a statement stating that storm insurance was a minor portion of the company’s offerings, but they declined to speak for this piece.

Out of approximately 27,000 homeowners insurance, the business estimated that at its height, it had written about 270 policies with storm coverage. “Island never played a big role in providing homes with storm insurance. We stopped this coverage because the cost of reinsurance for such a tiny portfolio was too high.

Although Island’s decision to discontinue storm coverage may not have had a big impact on Hawaii’s insurance market, it was a stark indication of the times from a venerable kamaaina business that was well-known for its community involvement.

Also Read: Kathie Lee Gifford Met Howard Stern in Person After Years of His Insults

Real estate realtor Dale Bordner of Honolulu has noticed a noticeable shift in Hawaii’s risk profile.

Bordner, who recently visited the National Association of Realtors’ legislative conference in Washington, D.C., where insurance concerns were a hot subject, said, “The Maui fires put us in a new category with insurance companies.” “It suddenly placed Florida and California in the high-risk list.”

The effects are being felt not just by the owners but also by prospective buyers and sellers inside the condo market.

In the past, a master storm policy would often cover 100% of the cost to repair the property in the case of a devastating hurricane at a condo complex. However, a lot of buildings have chosen to have less than 100% coverage because to growing rates.

That strategy is problematic because, according to lenders, condo associations are required by government mortgage firms Fannie Mae and Freddie Mac to get storm insurance that covers all possible damages. Even if a buyer is creditworthy, mortgage businesses that originate loans may refuse to lend to them in order to retain the possibility of selling the mortgages to government lending companies.

Lila Mower, a former banker for many years, has long been a champion for condo owners. According to her, some banks have been ready to finance condominiums in buildings with less than 100% coverage even if they don’t intend to sell their mortgages. To lower their risks, she added, banks frequently restrict the quantity of these loans in their portfolios.

Consequently, it might be challenging to get a mortgage.

According to Bordner, “it varies from lender to lender.”

According to Bordner, the difficulties are so great that one recent buyer had to contact two separate lenders on the mainland after failing to get a loan in Hawaii. According to her, it can take the market a year or longer to stabilize.

She remarked, “It’s obviously not an overnight answer.”

The Climate Advisory Team at Green is developing strategies. Green stated that one of the team’s goals in introducing the group is to lessen “financial burdens from the mounting repercussions of climate change.” The legal firms Hueston Hennigan and O’Melveny & Myers, as well as the investment bank Ducera Partners LLC, are members of the team.

Chris Benjamin, the team chairman, said in a statement that the group aims to be prepared to provide draft recommendations by September, but he denied an interview request.

Also Read: Breaking News: Networking-as-a-Service (NaaS) Revolutionizes Cloud Connectivity!

Benjamin, a former president and chief executive of Alexander & Baldwin, stated that Governor Green assigned the Climate Advisory Team the responsibility of investigating ways to meet the insurance problem associated with potential climate-related calamities. “To solve this difficulty, the team is in the process of identifying and engaging important stakeholders.”

Homeowners are facing increasing fees in the interim. Clemens stated he has heard that DB Insurance, the condo association’s insurance provider, may stop providing coverage for wood-frame properties entirely, which would increase worries at Manele Bay.

A request for response from DB executives was not answered.

Elaine Panlilio, the manager of Atlas’s AOAO section, took a call from Chason Ishii, president of the association’s insurance broker Atlas Insurance, but she declined to speak.

Government representatives should move swiftly, according to Clemens, who expressed gratitude that they are aware of the issues.

“I’m certain Green is aware of it,” Clemens remarked. “It will destroy Hawaii.”

-

Krispy Kreme’s Ghostbusters Doughnut Collection – A Spooky Collaboration for 2024

Krispy Kreme has always been known for its creative and exciting limited-edition doughnuts, and this October, the company has outdone itself once again. In celebration of the 40th anniversary of the cult-classic movie Ghostbusters, Krispy Kreme has launched a new collection of doughnuts inspired by the beloved film, offering fans a deliciously spooky treat that…

-

Ticketmaster to Pioneer New Apple Wallet Ticketing Feature on iOS 18

As the world anticipates the release of iOS 18, Apple has unveiled a revolutionary enhancement to its Apple Wallet—a feature that promises to transform the ticketing industry. Leading the charge is Ticketmaster, which is set to be the first major ticketing platform to implement this new feature. This collaboration between Apple and Ticketmaster will offer…

-

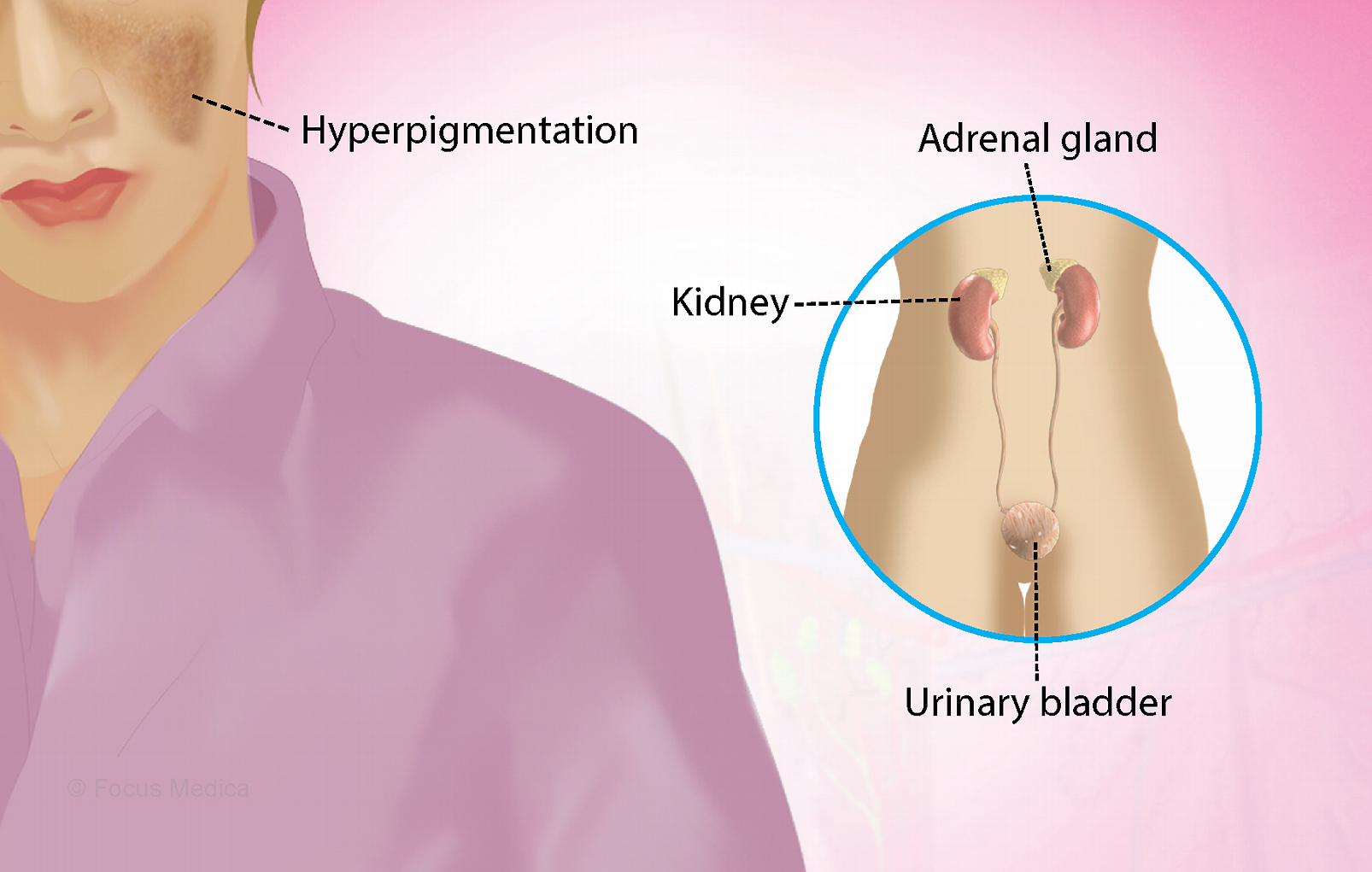

Breaking News – Addison’s Disease Rare Condition Affecting the Adrenal Glands

October 2024 – Addison’s disease, also known as primary adrenal insufficiency, is a rare yet serious condition that occurs when the adrenal glands fail to produce sufficient levels of cortisol and aldosterone. This hormonal imbalance can have a profound effect on various bodily functions, and without timely diagnosis and treatment, the disease can become life-threatening.…

-

Addison’s Disease – Rare Endocrine Disorder and Recent Advances in Treatment

Addison’s disease, also known as primary adrenal insufficiency, is a rare but potentially life-threatening condition caused by damage to the adrenal glands, which results in insufficient production of essential hormones such as cortisol and aldosterone. First identified by British physician Thomas Addison in 1855, this disorder can affect people of all ages, though it remains…

-

Northern Lights Forecast: Spectacular Aurora Expected Tonight

Tonight could offer a rare and stunning display of the Northern Lights, or Aurora Borealis, visible across several parts of the U.S. due to a severe geomagnetic storm forecasted by the National Oceanic and Atmospheric Administration (NOAA). This storm, rated G4 on a scale from G1 (minor) to G5 (extreme), is the result of a…

-

WWE Bad Blood 2024: Everything You Need to Know – Date, India Timings, Full Match Card, and How to Watch

WWE fans across the globe are eagerly awaiting the return of one of the most iconic pay-per-view events, WWE Bad Blood, which makes its triumphant comeback after two decades. Here’s everything you need to know about WWE Bad Blood 2024, including the match card, viewing options, and key event details. Event Overview Date: WWE Bad…

-

UNLV vs Syracuse Football Thriller – October 4, 2024

In a dramatic showdown on October 4, 2024, the Syracuse Orange narrowly defeated the UNLV Rebels 44-41 in overtime at Allegiant Stadium, Las Vegas. Both teams entered the game with matching 4-1 records, and the contest lived up to the hype with high-paced scoring and critical plays. First Quarter: Syracuse Takes Early Lead Syracuse took…

-

Joker 2’s Rotten Tomatoes Score: A Disappointing Turn for the Sequel?

Joker: Folie à Deux, the highly anticipated sequel to 2019’s Joker, has landed with less than stellar reviews, leaving fans and critics divided. Despite initial excitement, the Rotten Tomatoes score for the movie has raised concerns about its overall impact and reception. As of early October 2024, Joker 2 holds a disappointing Rotten Tomatoes score…

Dwayne Paschke specializes in writing, management, development, design and Search Engine Optimization. Although he has worked for 8 years in the industry, he never found an ideal person to work with as a partner. Later, he found Sebastian Pearson, and they both found specific understanding between them. Both of them divided their tasks in this project and are running this venture successfully.