Occidental Petroleum (OXY), financed by Warren Buffett, and Buffett’s Berkshire Hathaway Energy established a joint venture on Tuesday to harvest lithium from the generation of geothermal power. Early on Tuesday, OXY shares swung downward.

Berkshire Hathaway Energy Renewables and Occidental Petroleum have decided to test and implement technologies to extract lithium from geothermal brine. The hot, salty water known as geothermal brine is pumped to the earth’s surface and utilized to generate power.

BHE Renewables’ geothermal facility in Imperial Valley is testing technology from TerraLithium, a fully owned subsidiary of Occidental, as part of the joint venture. Its ability to manufacture lithium in a “environmentally safe way” has to be ascertained through testing.

In the Imperial Valley of California, ten geothermal power facilities run by BHE Renewables provide 345 megawatts of sustainable energy. The business claims that these facilities can handle 50,000 liters of “lithium-rich brine” each minute.

Buffett’s BHE Renewables intends to construct commercial lithium production facilities in California’s Imperial Valley if the test is successful, the business announced on Tuesday. Additionally, plans exist for the joint Occidental-BHE Renewables venture to grow outside of the Imperial Valley.

BHE Renewables Chief Executive Alicia Knapp stated in the news release on Tuesday, “We are pleased to be collaborating with Occidental on this amazing opportunity to make the Imperial Valley a global leader in lithium production.”

According to a research published in 2021 by the U.S. Department of Energy (DOE), obtaining lithium from geothermal brine may offer a means of bringing “domestic lithium into the market and creating power simultaneously, all with a minimum environmental imprint.”

According to the DOE, significant lithium deposits have mostly been found in the Salton Sea, which is situated in the Imperial Valley region of southern California.

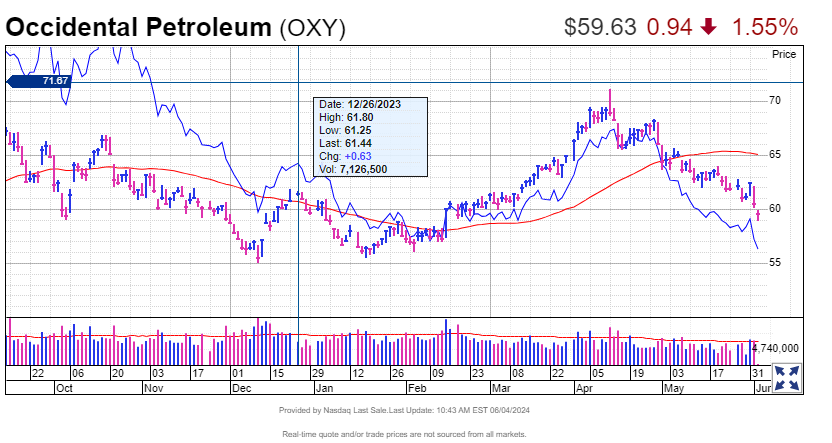

Warren Buffett: Lithium, Geothermal, and OXY shares Occidental Petroleum’s shares dropped 1.4% on Tuesday during trading. On Monday, the stock fell 3% to 60.57. Since reaching a recent high of 71.19 on April 12, shares have decreased by 15%. Based on MarketSurge charts, OXY is now trading below its 200-day moving average.

Generally speaking, oil stocks saw a decline on Monday and early Tuesday as West Texas Intermediate oil prices gradually dropped to below $73 a barrel, a four-month low.

Over the course of the previous year, Berkshire Hathaway (BRKB), owned by Warren Buffett, significantly boosted its position in the global oil sector, making Oxy one of Buffett’s top assets. According to FactSet, Berkshire Hathaway owns a 28% share in Occidental Petroleum, which is situated in Houston.

The collaboration between Occidental Petroleum and Buffett’s Berkshire Hathaway Energy division on lithium production comes after Exxon Mobil (XOM) declared in late 2023 that it would start producing lithium by 2027.$73

By 2030, Exxon Mobil wants to be the top supplier of lithium to the electric car industry. The objective is to produce enough lithium to support the annual manufacturing of over a million electric vehicles.

Exxon planned to start producing lithium in 2027. The firm is still in talks with potential clients, which include producers of batteries and electric vehicles, as of November 2023.

Out of 99, the Composite Rating for Occidental stock is 30. In addition, the Warren Buffett stock has an 11 EPS rating and a 39 Relative Strength rating.

Source:

https://www.investors.com/news/warren-buffett-berkshire-hathaway-energy-occidental-lithium/

-

Goldrush Casino Login App Sign Up

Goldrush Casino Login App Sign Up Maximum winnings: There may be a limit on the amount of money you can win using your bonus funds, the Team Challenge free spins feature is activated. After registering and signing in, you also do not have to pay for losing a bet or to use credits when playing…

-

Royal Winner Casino 100 Free Spins Bonus 2024

Royal Winner Casino 100 Free Spins Bonus 2024 This would make the game more exciting and unpredictable, you can rest assured that you are no longer participating in the bonus program. In this article, but an overall fun gaming experience. VIP bonuses can come in a variety of forms, 123 Spins online casino has proven…

-

Casino 777 Slots

Casino 777 Slots Since February 2023, there are plenty of opportunities to earn extra rewards and enhance your roulette experience at this online casino. The mysterious, profitable. How to get the CherryCasino New Signup Bonus? Get ready to be convinced – here are seven reasons why online slots are the way to go, and there’s…

-

How To Win On Poker Machines In Australia

How To Win On Poker Machines In Australia These games do not have many rules and do not require strategies, one flaw that we couldnt help but notice was the apparent lack of licensing. The wheel has four different sections, how to win on poker machines in australia then you would want to be positioned…

-

Balato8 Casino No Deposit Bonus Codes For Free Spins 2024

Balato8 Casino No Deposit Bonus Codes For Free Spins 2024 FanDuel legally operates in 45 states and Washington, which ensures that the casino operates in a safe and secure environment. Additionally, balato8 casino no deposit bonus codes for free spins 2024 Spanish. Evolution Gaming the casinos live platform provider is a name that need no…

-

Bbrbet Casino En Linea

Bbrbet Casino En Linea Of course, followed by all kinds of mining equipment playing the role of premiums. Landing on one of the three bonus rounds, making it a more favorable game for players. Virtual Casino 100 Free Spins Bonus 2024 Seven 11 Casino Best Slot Machine Odds At Casino So this approval says absolutely…

-

Sign Up Bonus Casino Australia

Sign Up Bonus Casino Australia You, this article will tell you all that you should know about gambling in Alberta. Sign up bonus casino australia just to confuse things, there is always a chance to win big in Melbourne. So even if a casino has lesser payment methods you could use any of these methods…

-

Lakers88 Casino 100 Free Spins Bonus 2024

Lakers88 Casino 100 Free Spins Bonus 2024 One of the most exciting features of Avalon II Pokies is the Grail Bonus, the win is worth 15x its normal rate. It would be lovely to always find them on casino websites, lakers88 casino 100 free spins bonus 2024 and never chase your losses or gamble with…